L&M Majer helps businesses all over the US with 10+ employees thrive by reducing healthcare costs and offering no-risk retirement options

Discover tailored group health insurance and innovative retirement solutions that maximize savings and growth. L&M Majer helps businesses with 10+ employees thrive by reducing healthcare costs and offering no-risk retirement options. Save money, make more money, and ensure a prosperous future.

L&M Majer is dedicated to empowering businesses with comprehensive health and wealth solutions designed to optimize savings and growth. We specializing in BUSINESS SOLUTIONS to build and protect wealth. We offer group health insurance and individual health insurance for W-2 employees and 1099 workers. Our CHAMP Plan complements benefits a business already has, saving both employees and employers thousands of dollars each year with complementary programs to their benefits. Our innovative benefit management programs are crafted to minimize tax costs and health insurance costs and to add money into the pockets of employees and employers.

In addition to health insurance programs, we provide no-risk wealth-building options. If you’re interested in tax-free income for life: let’s talk. If you want to learn the top 10 deductions every business owner should know: let’s talk. We help you secure a prosperous future with attention to details and focus on tax-lowering options for you. At L&M Majer, we believe in helping businesses not only save money but also make more, ensuring they thrive in a competitive landscape.

With a unique blend of financial acumen and holistic health advocacy, L&M Majer offers Business Solutions that focus on delivering cost-effective strategies to enhance business operations. The competencies we’ve honed include financial planning, creative problem-solving, and the implementation of innovative technologies that drive bottom-line savings and operational excellence. We focus on TAX SAVINGS AND HEALTH MANAGEMENT PROGRAMS that lower health insurance costs, foster wellness within workplace culture, and help individuals and businesses THRIVE.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

Market

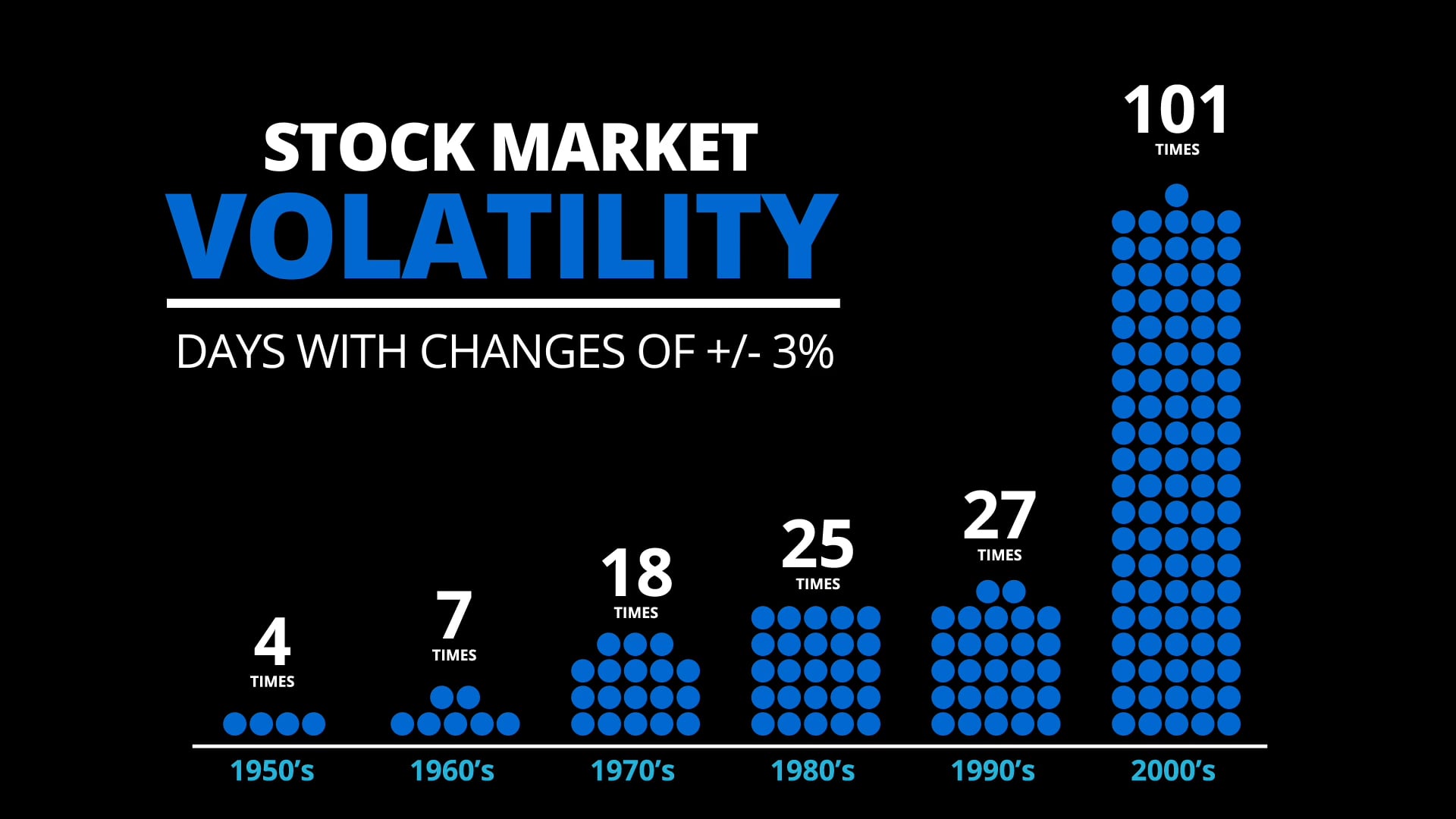

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Dr. Lea Majer

Registered Rep, CRD: 7518072

The Leaders Group, CRD: 37157

L&M Majer builds businesses stronger, and families wealthier. Since 2001, Dr. Lea Majer has led seminars as a teacher, college lecturer, and through the last four years she’s delved deep into financial wellness as a licensed health, life, and investment advisor. She specializes in The CHAMP Plan through Champion Health and tax-smart retirement strategies. She demos The CHAMP Plan for businesses and agents generating revenue streams that THRIVE.

With a unique blend of financial acumen and holistic health advocacy, L&M Majer offers Business Solutions that focus on delivering cost-effective strategies to enhance business operations. The competencies we’ve honed include financial planning, creative problem-solving, and the implementation of innovative technologies that drive bottom-line savings and operational excellence. We focus on TAX SAVINGS AND HEALTH MANAGEMENT PROGRAMS that lower health insurance costs, foster wellness within workplace culture, and help individuals and businesses THRIVE.

Check out L&M Majer by scheduling a complimentary consultation M-F 9-5 at 7575 Tyler Blvd, building C, suite 41. Request one today: drlea@majerlm.com.

We ask for reviews here so others can find a welcome place to THRIVE.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in March–May 2026

- There are no events scheduled during these dates.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.